Financial Markets Standards Board (“FMSB”) has today set out its workplan for 2026.

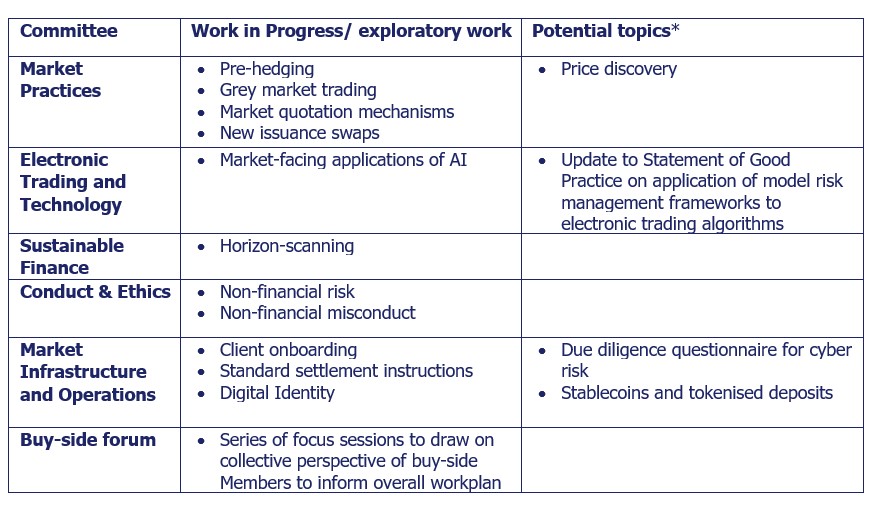

The plan sets out FMSB’s proposed programme of work for the year across its five Committees and newly established buy-side forum. The workplan focuses on processes and behaviour in wholesale financial markets and covers issues that may be conduct-related or operational in nature where these have the potential to affect market fairness or effectiveness.

The topics included in the workplan are intended to address one or more of the following thematic areas, in line with FMSB’s remit:

• reduce uncertainty and ambiguity in prevailing market practices;

• bridge gaps between regulation and evolving market practices or structures;

• identify and respond to emerging market threats or trends; and

• strengthen and promote the convergence of international market standards.

Myles McGuinness, CEO of Financial Markets Standards Board Limited said:

“We are pleased to set out FMSB’s Workplan for 2026. FMSB is a unique organisation that brings the industry and other relevant stakeholders together to address both behavioural and operational market challenges in an effective, pragmatic way.

The wide range of work in progress, as well as those topics that have emerged from Committees’ horizon scanning as potential areas of focus is a reflection of Members’ strong engagement and support for FMSB as we enter our next decade.

We look forward to drawing on the expertise of our Members to address pertinent areas such as AI in trading, non-financial risk and misconduct and digital identity. Our newly established buy-side forum will also bring together the increasing number of FMSB Members on the buy side to harness their insights.”

More detail on our work in progress and potential topics can be found in the complete 2026 workplan, set out on our web site, and reference can also be made to our recent Future of financial markets report.

*FMSB’s Standards Board will determine the relative priority of potential topics and where to form Working Groups to progress new areas of work as 2026 progresses. New topics may emerge during the year which Members elect to prioritise and we will update the workplan mid-way through the year.

Notes to editors

About FMSB:

- Financial Markets Standards Board (FMSB) is an industry-led, member-funded global standards body for the wholesale financial markets.

- Created out of the Fair and Effective Markets Review (FEMR) in 2015, FMSB brings together its Members from banks, investment institutions, infrastructure and information providers, corporates, pension funds and non-bank liquidity providers, to develop Standards, Statements of Good Practice and Spotlight Reviews that raise standards of behaviour, competence and awareness – to promote the fairness and effectiveness of global wholesale financial markets.

- As well as standard setting, subject matter experts from member firms debate issues in working groups and are able to benchmark their approaches against industry peers, thus helping to lift standards of conduct.

- FMSB’s full membership list is here

For more information:

Laura Conaghan

+44 (0)203 961 6150

Laura.conaghan@fmsb.com