Work in Progress:

Standards, Statements of Good Practice and Spotlight Reviews are produced by FMSB’s cross-sectoral committees and working groups, each of which follows a rigorous production and review process.

Information about each of FMSB’s active groups is set out below with an update as at 27 July 2022. For an overview of all activity please see our ‘FMSB Workstreams on a Page’.

blank

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Conduct & Ethics

Conduct & Ethics Sub-Committee

Chair: Tracey McDermott, Group Head, Conduct, Financial Crimes, Compliance at Standard Chartered

Exploratory work has commenced in relation to the Three Lines of Defence, and future work may include looking at the current challenges of new joiner integration and data ethics.

Recently completed and ongoing work includes:

- examining remote working risks;

- hybrid working – future risk management frameworks;

- behaviour-pattern conduct analysis; and

- the development of conduct training and qualifications.

Electronic Trading and Technology

Chair:

Ciara Quinlan, Head of Principal Electronic Trading for Global Markets, UBS and FMSB Standards Board Member

The Electronic Trading and Technology Committee is currently addressing two topics in separate Working Groups covering Trading Platforms and Algo Model Risk.

Trading Platforms Working Group

The Working Group published a Statement of Good Practice in June 2022 aimed at promoting greater transparency as to how both bilateral and multilateral electronic trading platforms operate and seeking to ensure consistency of disclosures made by all trading platforms to their participants or prospective participants across FICC markets and asset classes. Increased transparency and standardisation of disclosures should in turn help minimise disputes between trading platform operators and their participants.

Algo Model Risk Working Group

This Working Group has been set up to look at the application of model risk requirements to trading algorithms, and in particular whether a FMSB publication could help firms advance practical implementations of model risk requirements that effectively mitigate risk through appropriate governance and controls.

ESG

Chair: Caroline Haas, Head of Climate and ESG Capital Markets, NatWest Markets

The ESG Ratings Working Group published a Spotlight Review in July 2022 focusing on increasing the transparency of ESG ratings methodologies and data collection processes to promote user understanding, aid comparability across providers, improve trust in ratings and thereby support informed allocation of capital.

Exploratory work has commenced on Voluntary Carbon Markets and conduct risks associated with the growth of sustainable finance/greenwashing.

Market Practices

Market Practices

Chair – Charles Bristow, Global Head of Rates Trading, J.P. Morgan and Member of the FMSB Standards Board

FMSB is currently horizon scanning to determine its forthcoming focus in this area.

Precious Metals Working Group

Chair – David Tait, CEO of World Gold Council and Member of the FMSB Standards Board

This Working Group published a Spotlight Review in June 2022 examining the existing trade settlement and confirmation process, highlighting the market inefficiencies and suggesting possible solutions on improving the market operations.

Post-Trade

Chair – David Hudson, Co-head CIB Digital and Platform Services, J.P.Morgan

A Post-Trade Committee with three working groups under it has been established to consider the potential implementation of the Post Trade Task Force’s recommendations.

The three working groups under the Post Trade-Committee are:

1. Non-Economic Trade Data (Chair: Robert Lamb, BlackRock)

2. Uncleared Margin (Chair: Philip Glackin, J.P.Morgan)

3. Client Onboarding (Chair: Siobhan Clarke, Royal London)

Each of the working groups will consider the PTTF recommendations relevant to their workstream as outlined in the BoE report and in light of FMSB’s mandate before reporting back to the Standards Board and deciding on next steps. The Committee itself will perform a steering role in line with FMSB’s other existing Committees with substantive outputs being generated by the working groups.

FMSB is currently exploring options for Standards for the use of Consolidated Tape in the global wholesale financial markets.

FMSB Working Group Terms of Reference – May 2022

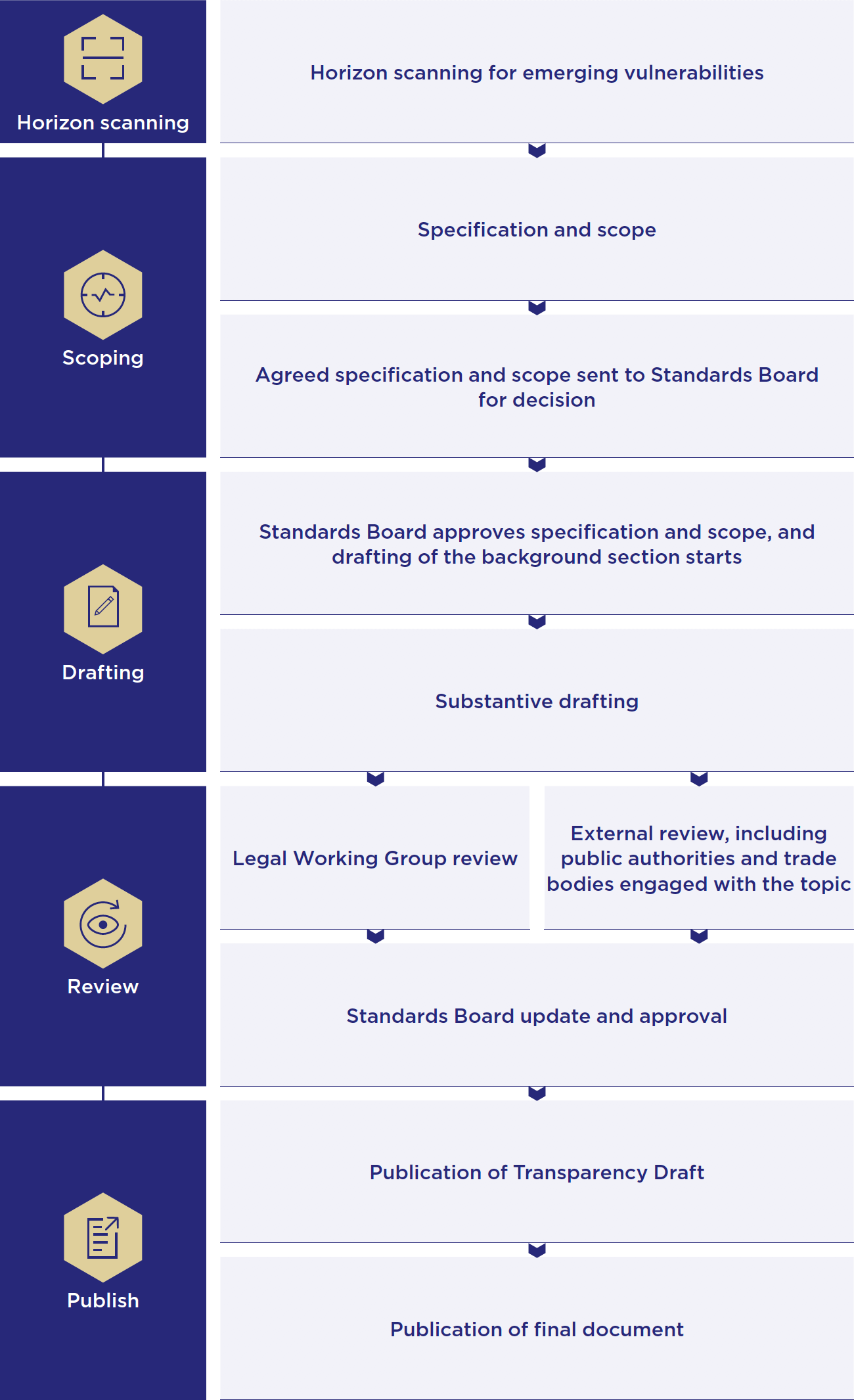

How does a typical Standard or Statement of Good Practice progress to publication?